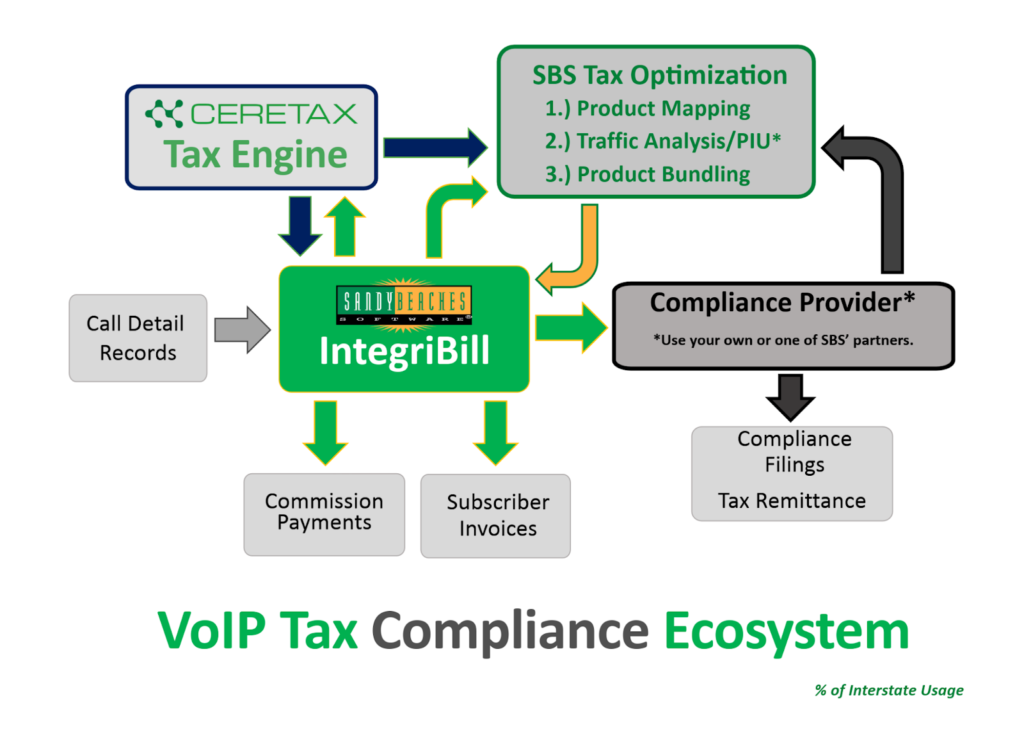

The Three Legs of Telecom Tax Optimization

Tax Mapping

Tax mapping is the foundation of telecom tax optimization. CereTax—the telecom tax engine used by Sandy Beaches Software—supports 174 distinct telecom tax mapping codes. Applying the correct tax code to each service is the first and most critical step. The SBS staff helps clients navigate tax mapping during our onboarding process.

Not All Services Are Taxed the Same Way

For example, a Caller ID Name (CNAM) lookup that utilizes the PSTN is taxed differently than a CNAM service delivered solely over the Internet. Understanding what services are being provided and how they are delivered is essential to applying the correct tax treatment and avoiding unnecessary tax exposure.

Correct tax mapping ensures

Accurate tax calculation

Reduced over-collection

Defensible compliance during audits

Expert Bundling Review Included

Federal Universal Service Fund (FUSF)

FCC 64.9% Interstate Safe Harbor

The safest, simplest method—but often the most expensive.

- Requires no supporting traffic documentation.

- Considered the lowest-risk method.

- Automatically classifies 64.9% of VoIP revenue as interstate.

Traffic Analysis (Traffic Study)

A balanced approach using statistical sampling.

- Examines VoIP call jurisdiction over a representative period.

- Determines actual interstate and international usage percentages.

- Must be statistically valid (95% confidence level).

- Requires documentation of sampling methodology.

- Must be reported annually on FCC Form 499-A.

Allocation Using Actual Call-Detail Records (CDRs)

The most precise—and often the most tax-efficient method.

- Uses 100% of subscriber CDRs for the billing period (not sampling).

- Calculates interstate and international allocation based on actual minutes of use.

- Divides interstate + international minutes by total minutes (local + intrastate included).

Bundling Services

The Most Complex Leg of Tax Optimization

Bundling is the most complex—and most often misunderstood—leg of tax optimization. Getting it right can significantly reduce tax exposure—but getting it wrong can increase risk.

Common Bundle Components

When selling a hosted seat or bundled offering, multiple components may be included:

- VoIP access

- Calling features

- DIDs

- Unlimited domestic calling

- Auto attendant

- Call recording

- Software

- Service and support

What's Right for Your Organization Depends On:

- How services are marketed and described.

- Whether components are separately stated or bundled.

- Revenue allocation methodology.

- State and local tax rules.

- Audit defensibility and documentation.

- Over-collection

- Under-collection

- Audit findings